Insurance providers go by several criteria which drivers obtain the best rates.

Every company has their own way of calculating your risk level and premium rates. You will find the policy that is most affordable and best suited to you by checking into policies from several competitors.

Bodily Injury

If you buy aftermarket enhancements for your car, determine the insurance consequences should your car get damaged or stolen. In a lot of cases, insurance companies do not cover these upgrades. They only consider the added value to the entire car.

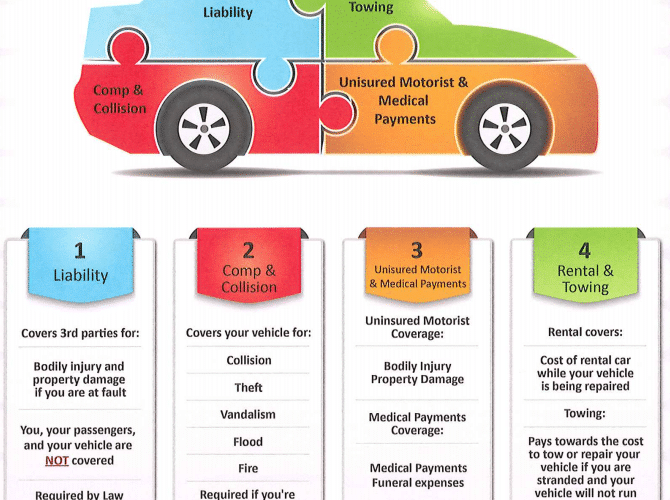

You need to understand the various coverage types offered when you are searching for an auto insurance policy. There are many different situations that go into your final cost of insurance. If you cause an accident that results in the death or bodily injury of another person, bodily injury liability will cover all legal costs and injury claims.

Property damage liability is a very important feature of your car insurance policy. This way you know that you will cover damages your vehicle in an accident. Most states actually require this liability.

The best auto insurance payments low is to maintain a spotless driving record. A car accident will increase your auto insurance rates faster than anything else. Know your own driving limits, and avoid risks that could cause accidents.

A large part of your monthly car insurance bill will depend on what kind of vehicle you buy. You may have refined tastes and want something luxurious, but the insurance bill will reflect this choice. If you want to save money on your insurance policy, you need to choose something both modest and safe.

This is a risky move, but as long as you’re willing to set aside money each month to cover the cost of your deductible in case of an accident, you might come out ahead in the end. Your premiums will cost less if you choose the higher deductible.

You need to read all the language in the contract, such as the amount of the deductible, the levels of coverage and the limits on benefits provided.

Insurance companies are not all different. If you are unhappy with the quote you received on your car, shop around and get others.

Lower your mileage by using public transportation or joining a carpool. One way to secure lower insurance premiums is to use public transportation, so you can put fewer miles on your vehicle. If you take public transportation, chances are your insurance agent can find a way to discount your policy.

Talk to your agent if you’re thinking of switching companies due to a quote from another company.

It can be difficult to decide how much insurance policy. If you are relatively well off, then you need enough liability coverage to protect your assets. If you get involved in an accident and hurt someone, the other person could take you to court for their medical bills beyond what your insurance covers. It is more prudent to get enough coverage to protect your savings and be safe.

If you are ever in a car accident and need to file a claim, be sure to get plenty of documentation. It may even make sense to keep a camera with you in the vehicle so that you are prepared for any circumstance.

To lower car insurance costs, don’t share cars among members of your family. Typically, you will get a better price by only having one name attached to each vehicle.

Consider how much monthly insurance rates will be before purchasing a new car. Auto coverage offered by insurance companies can be less expensive on a better rate for cars that are newer and equipped with more safety features. You must factor in this expense as a part of your budget whenever you will purchase.

Reasonably priced auto insurance rates are not the rare occurrence they may seem to be. You can substantially lower your premiums by using the tips in this article.