Insurance providers go by several different criteria to decide which drivers obtain the best rates.

Make sure your license clean. If you have had tickets or gotten in accidents in the past, see if you can lower your insurance premium by taking a driving course.

Your vehicle’s make and model is the size of your monthly insurance payment. If saving money is your primary concern, pick something safe and reliable that is sold at a modest price.

If you’ve been thinking about adding aftermarket parts to your car, check with your insurance company to see if they will cover the damage of these parts. Insurance often doesn’t cover these parts separately, but only the difference between the value of the car with and without those parts, which is often not a lot.

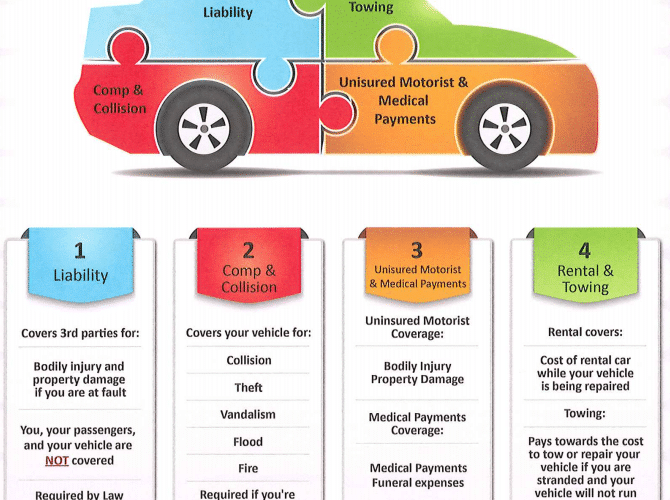

Make sure you know what coverage types are important when choosing auto policy must have with respect to coverage. There are many options available, but most of them aren’t right for you. However, if you are not a great driver or have gotten in a number of small crashes or fender benders, obtaining collision coverage could give you peace of mind.

Try taking the bus or take a carpool. Insurance companies appreciate their customers being responsible clients.

When you buy car insurance, remember that only you are covered unless you specifically add others to your policy. If you loan someone your vehicle to drive, chances are your insurance will not pay. You might have to pay more to cover other drivers using your coverage to allow for this.

You should always check the possible insurance rates if you are purchasing a new vehicle. Your insurance agent should know which cars have low premiums. Doing so can help when buying any type of new or used car. It is possible for you to save a good amount of money on car insurance if you purchase a car with a high safety rating.

Think carefully about buying after-market add-ons if you might not need.

Do not pay the monthly payments. Your auto insurance provider could have added anywhere from three to five extra dollars to your bill. This small amount can add to your bill quickly. It can also a hassle on top of all your other bills. The fewer payments you have to worry about, the more money you save.

Don’t automatically accept the cheapest auto insurance quote you receive. Cheap may be exactly what you need.

In many states, all drivers are required to purchase adequate liability insurance. Remember that the responsibility for carrying the legally-required level of insurance lies with you, not your insurance company. You will break the law and face financial consequences if you have no insurance and get into an accident.

Think about removing some coverage items off of your auto insurance. If your vehicle is older and less valuable and your policy includes collision insurance, you may just want to cover your car with liability insurance. You may find that you save a considerable amount of money by eliminating unnecessary coverage. You should also want to consider dropping comprehensive and liability coverage.

Ask your insurance agent for a list of the money-saving opportunities their company provides.

Insurance against uninsured drivers, as well as non-accident damage to your car like fire or flood, like in a fire.

The majority of people think car insurance rates for young drivers will drastically decrease as soon as they turn twenty-five. The truth is that premiums start to decrease when a person reaches the age of 18, assuming that he or she is a safe driver.

Take an inventory of all of them, in order to ensure you take advantage of these price savers.You may also save by claiming discounts.

Many insurance companies give discounts to people who do not drive less. This makes cutting your driving a great option for anyone who wants to save money.

100/200/100 level liability coverage is a great thing to include in your auto insurance policy if you have an expensive car.

They type of vehicle you buy will play a huge role in the price you pay for your insurance policy. Depending on your taste in vehicles, from a luxury model hybrid to a beat up gas guzzler, your insurance premium will reflect that taste. Choose something nice, safe and reliable over a flashier option to save big on insurance bills.

The amount of your deductible is the single biggest factor determining how much you will pay for insurance. Remember that you will have to pay a higher amount if you get into an accident. You should put some money to the side in case you need it.

So as you can see, getting affordable car insurance doesn’t have to be an impossible quest. Use the advice in these tips to lower your premiums and be able to afford better coverage.