Term existence insurance may be cheap, but don’t forget it doesn’t last. The main feature of term insurance is it costs much under a conventional policy. Remember, though, that the traditional existence insurance plan is really a permanent financial asset, even one you are able to borrow against. In comparison, term existence insurance lasts only as lengthy while you continue the instalments.

Find the correct kind of existence insurance plan for your requirements. The 3 fundamental types are, whole existence, term existence and variable existence. Whole existence policies would be the most costly, however they operate similar to a checking account, meaning which you can use it as being a good thing later on, whether it has not been used.

You should possess a sufficient existence insurance plan. You ought to have enough insurance to pay for a minimum of 5 years of the current salary, if you’re married. For those who have children or many financial obligations, you ought to have up to 10 years salary’s price of existence insurance. Insurance can help all your family members cover expenses when you’re gone.

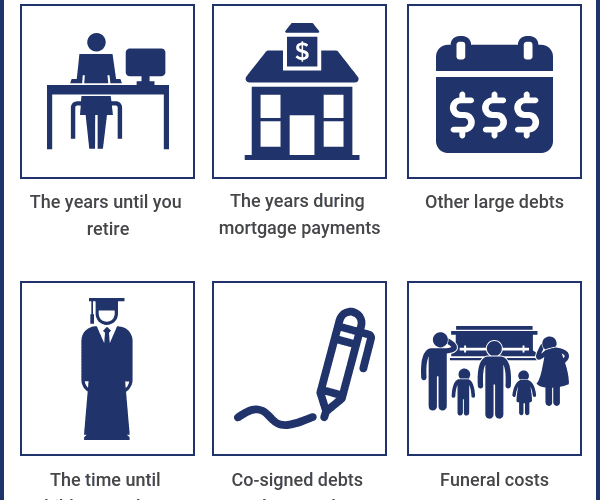

Determine what you need for existence insurance. There are lots of calculators online that may help you get a concept of what’s going to be required to cover your survivor’s expenses. Investigate the different options to assist decide just how much coverage works perfect for your family.

Don’t purchase more existence insurance than is essential for the family’s needs. The greater your coverage is, the greater your premiums is going to be. Millions of dollar policy sounds nice, but it’s possible you’ll never even need to cash it. Save the cash and merely select a policy that covers your requirements.

There is no need to purchase right into a existence insurance plan that pays out a lot. The only real factor this is going to do is cause you to broke when you’re alive. Rather, just subscribe to an insurance policy which will provide all your family members with plenty of funds upon your dying.

Get a lean body before you take out a existence insurance plan. Existence insurance could be costly. It’s much more costly if you’re ill. Prior to taking out an insurance policy, make sure to get fit. Helpful tips, slim down, do anything whatsoever it requires. This can lower your costs dramatically.

Read all the small print from the policy prior to signing at risk. Understand what discounts, exclusions, inclusions, and then any other small print is incorporated around the agreement. You might find that there’s a no payment clause for pre-existing illnesses. Careful studying can help you make sure your spouse can get the cash they’ll need.

Professions and hobbies which are regarded as hazardous, are likely to raise the price of your existence insurance. Consider quitting skydiving, horseriding and diving, in the event that your minute rates are excessive. Visiting dangerous areas all over the world, may also cause you to ineligible for discounts.

Term existence insurance coverage is the kind of policy that many it’s advocated that individuals purchase. This gives insurance around the existence from the insured individual for any predetermined time, for example ten or twenty years. Premiums are usually compensated yearly, and when the word expires, the insurance policy expires too. At that time, the insured’s needs might have altered and she or he might not require a existence insurance plan any longer.